Alright, buckle up, because we’re diving into the finance realm to demystify how you calculate the big shots: nominal and real interest rates. Ever wondered, “How do you calculate nominal and real interest rates?” Well, we’re about to break it down like you’re five years old, but, you know, in a cool way.

Let’s start with the rockstar of the show: the nominal interest rate. This one’s the headline act, the rate your bank flaunts like a shiny new toy. It’s the percentage increase in your money over a year, basically what you’d earn without considering the pesky effects of inflation. Imagine you stash $100 in your savings account, and after a year, you end up with $110. That extra $10? That’s your nominal interest, usually expressed as a percentage.

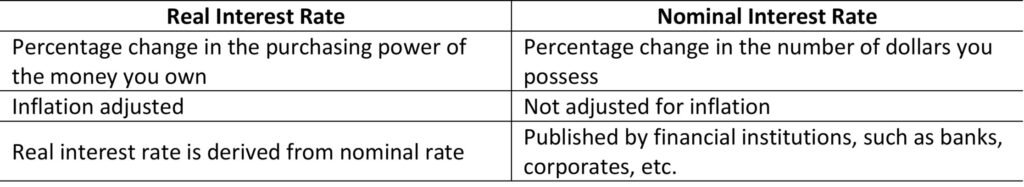

Now, let’s throw a curveball into the mix: inflation. Inflation is like the sneaky thief in the night, quietly eroding the purchasing power of your hard-earned cash. Real interest rates, my friend, are the ones that give inflation the side-eye and factor it into the equation. You calculate real interest rates by subtracting the inflation rate from the nominal interest rate. It’s like saying, “Alright, Mr. Nominal Interest, you’re cool and all, but let’s consider the real cost of living.” So, if your nominal interest rate is 5% and inflation is 2%, your real interest rate is 3%. That’s what your money’s truly gaining in purchasing power.

So, there you have it, champ. Nominal interest rates are the flashy upfront numbers, while real interest rates are the smart, streetwise cousins that factor in the cost of living. How do you calculate nominal and real interest rates? Well, now you know—it’s all about understanding the numbers game and keeping an eye on that sneaky inflation bandit. Stay wise, stay calculating!

Click Here if you are interested in Forex.